Iran Polyethylene Export Landscape

Over the past decade, Iran polyethylene export has played a central role in the regional and global polymer market.

Drawing on verified data from IRICA, Trade Map, and Export Potential, this article reviews both HDPE and LDPE exports to identify key shifts in supply, demand, and pricing.

The data show that Iran has consistently been a reliable supplier of polyethylene, with volumes fluctuating year by year in response to global pricing pressures and demand from major importers such as China and Turkey.

These dynamics not only reflect Iran’s competitiveness in terms of export volume and value, but also demonstrate the country’s growing importance for global buyers seeking cost-effective polymer sources.

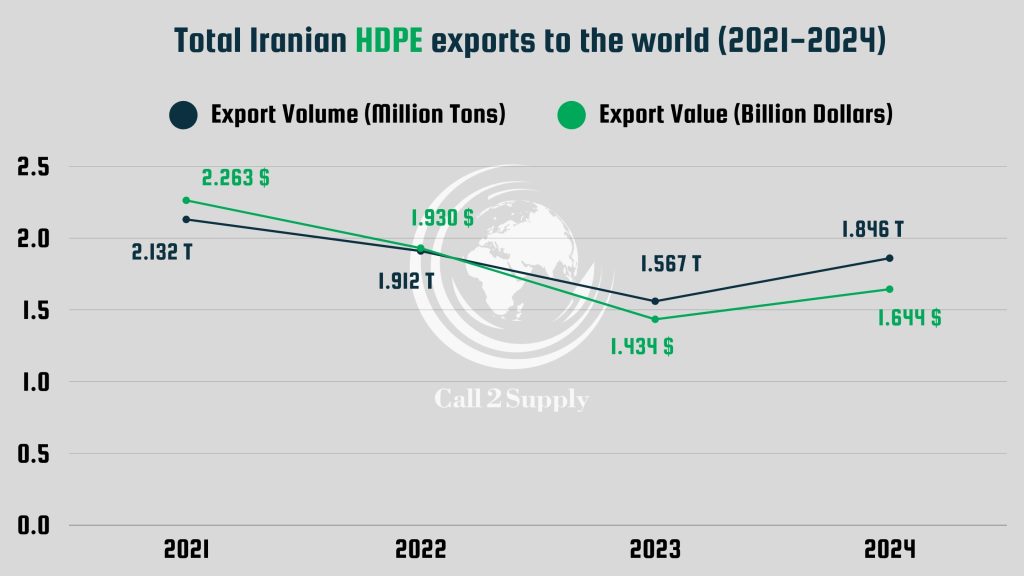

Iran Polyethylene Export Performance (HDPE – 2021–2024):

Over the past four years, HDPE exports from Iran have experienced significant fluctuations in both export volume and export value.

According to official trade data from IRICA and Trade Map, the strongest year was 2021, when Iran recorded its highest HDPE export volumes.

In 2022 and 2023, however, HDPE exports declined, reflecting global demand changes and stronger competition in Iran polyethylene Export market.

The trend reversed in 2024, when export volumes rose sharply to an impressive 1.846 million tons.

Yet, despite the growth in quantity, the overall export value decreased.

This drop indicates more competitive pricing strategies by Iranian suppliers compared to other HDPE exporters in the region.

For international buyers, this development represents an opportunity to source HDPE at lower average prices while maintaining access to stable and high-volume supply from Iran.

Top Importing Countries of Iran’s Polyethylene

According to IRICA data for 2024, Iran’s polyethylene exports — both HDPE and LDPE — were concentrated in a few dominant markets.

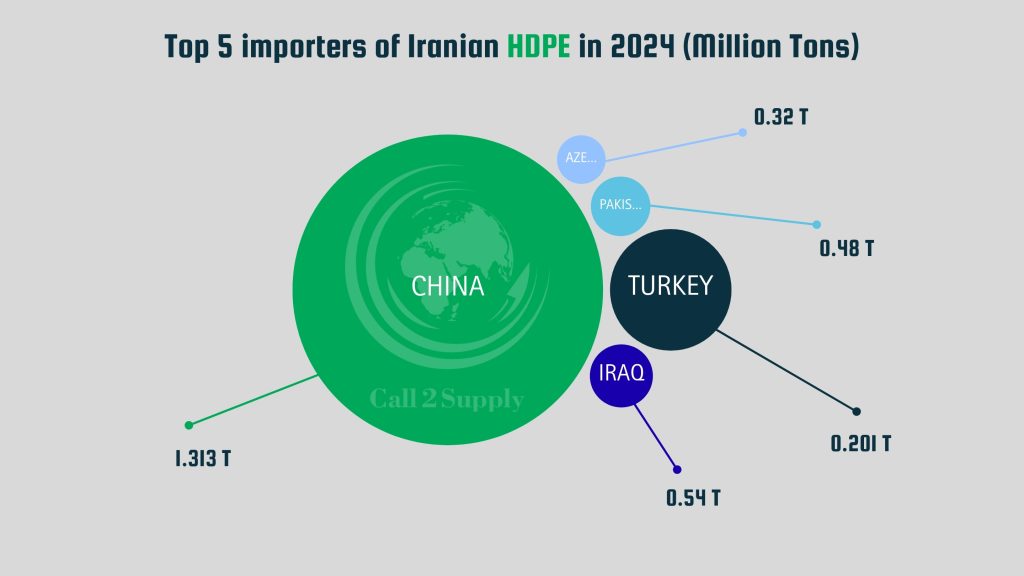

HDPE Importers (2024):

China was by far the largest buyer, accounting for over 63% of total export value. Turkey ranked second with about 20%, followed by Iraq, Pakistan, and Azerbaijan. These figures reflect Iran’s strong position in both major Asian economies and neighboring regional markets.

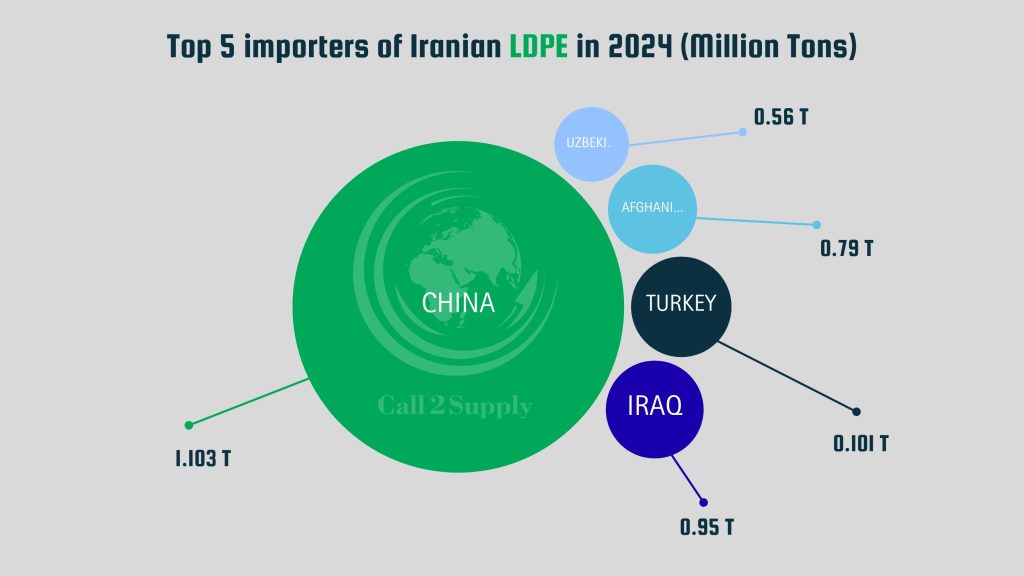

LDPE Importers (2024):

The picture is similar for LDPE. China once again led with 77% of Iran’s LDPE exports, while Turkey came second. Uzbekistan, Afghanistan, and Iraq also emerged as important destinations, highlighting Iran’s expanding reach across Central Asia.

Key Insight (IRICA Data)

While IRICA’s 2024 data confirms that China accounts for the majority of Iran polyethylene export — over 63% for HDPE and nearly 78% for LDPE — this concentration also signals significant opportunities for new buyers.

For importers in Turkey, Uzbekistan, Iraq, and Central Asia, Iran’s strategic push to diversify beyond China creates a window to secure:

- Stable and high-volume supplies of HDPE & LDPE

- Competitive pricing, driven by Iran’s position in global polymer trade

- Geographical proximity advantages, reducing transportation costs and delivery times

Instead of being a risk, China’s dominance highlights Iran’s strength in the global polyethylene market, while opening doors for regional and global buyers to negotiate better terms and build long-term supply partnerships.

Trade Map Analysis: HDPE & LDPE Exports

While IRICA gives us the raw export volumes, Trade Map’s global trade database provides a wider perspective crucial for analyzing Iran polyethylene export destinations and competitive standing. These two indicators highlight not only where Iran is selling today, but also where future opportunities may be stronger.

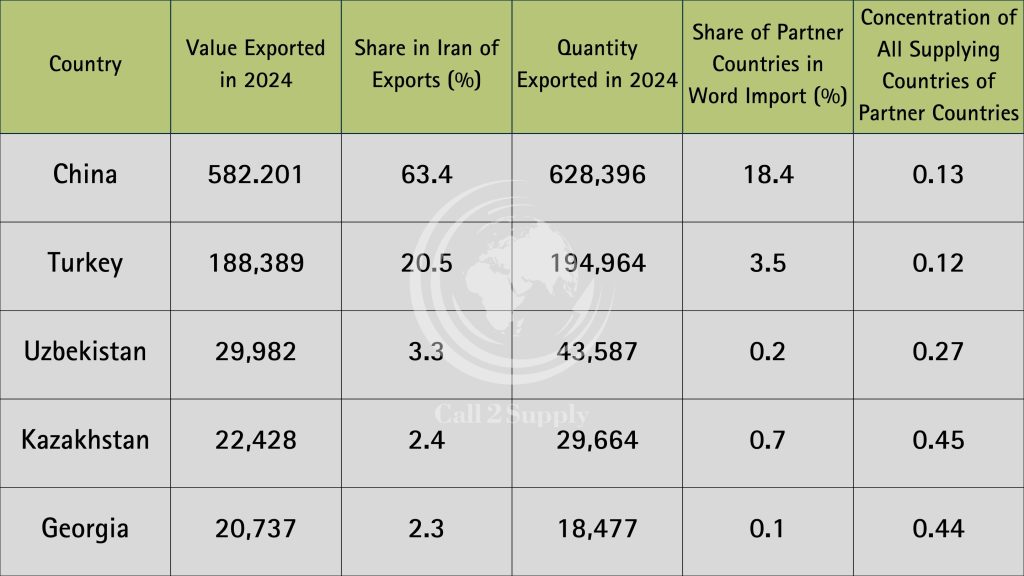

HDPE (2024 – Trade Map):

China accounted for 63.4% of Iran’s HDPE exports, but because supplier concentration is just 0.13, the Chinese market is highly competitive with many global players involved. In contrast, Kazakhstan (0.45) and Georgia (0.44) show much higher concentration levels. This means fewer suppliers are active in those markets, giving Iran a more strategic position and higher chances to expand its share.

LDPE (2024 – Trade Map):

Again, China was the dominant buyer with 77.6% of Iran’s LDPE exports. However, the supplier concentration was only 0.11, signaling intense competition. Markets such as Uzbekistan (0.26), according to Trade Map’s official indicators, offer a more favorable environment where Iranian suppliers can secure long-term relationships with importers thanks to limited foreign competition.

Overall, Trade Map data shows that while China remains Iran’s top buyer in both HDPE and LDPE, the most promising opportunities for stable growth are in secondary markets like Turkey, Uzbekistan, Kazakhstan, and Georgia, where fewer suppliers operate and Iran can build a stronger foothold.

Current Analysis: First 4 Months of 2024 vs 2025

After analyzing historical trends and Trade Map data, it is time to look at the short-term performance of Iran polyethylene export by comparing the first four months of 2025 with the same period in 2024. This comparison gives foreign buyers a clear picture current supply and pricing dynamics.

HDPE Export Analysis: First 4 Months of 2024 vs 2025 :

| Data | Volume (Kg) | Value ($) |

| 2024 | 627,432,657 | 571,816,663 |

| 2025 | 640,805,343 | 542,017,549 |

Analysis: HDPE volume increased slightly by 2.1% (13.3 million Kg), yet the export value dropped by 5.2% ($29.8 million). This suggests a continuation of Iran’s competitive pricing strategy to secure market share, making Iran polyethylene export highly attractive to importers seeking lower average prices.

LDPE Export Analysis: First 4 Months of 2024 vs 2025 :

| Data | Volume (Kg) | Value ($) |

| 2024 | 590,353,943 | 610,824,205 |

| 2025 | 545,577,607 | 536,137,892 |

Analysis: LDPE exports faced a reduction in both volume (7.6%) and value (12.2%). The larger drop in value indicates falling prices per kilogram, signaling lower demand or increased competition in key markets. However, the analysis of Iran polyethylene export trends confirms that China remains by far the top importer of both HDPE and LDPE.

Export Potential Forecast for Iran’s Polyethylene (2025–2030)

Past data shows where Iran has been successful, but the Export Potential Map points to the future. It highlights which countries will create the highest demand for Iranian HDPE and LDPE over the next five years

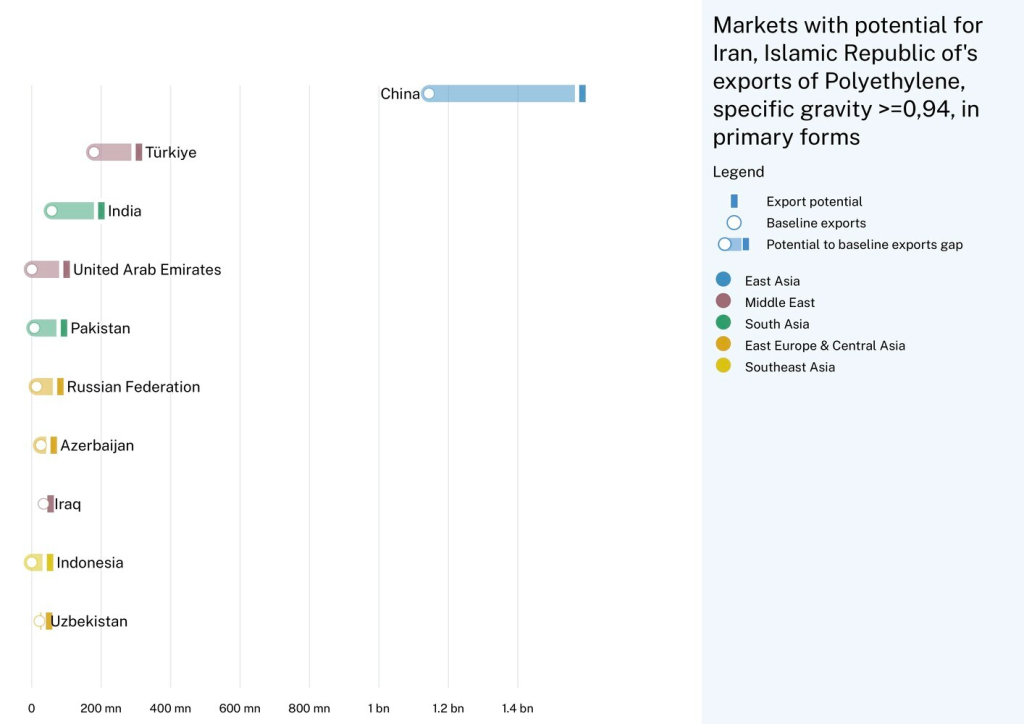

HDPE Future Markets (2025–2029):.

China will remain the largest buyer. However, countries such as Turkey, India, the UAE, Pakistan, and Russia are expected to grow strongly. By 2029, Turkey and India could play a key role in reducing Iran’s reliance on China.

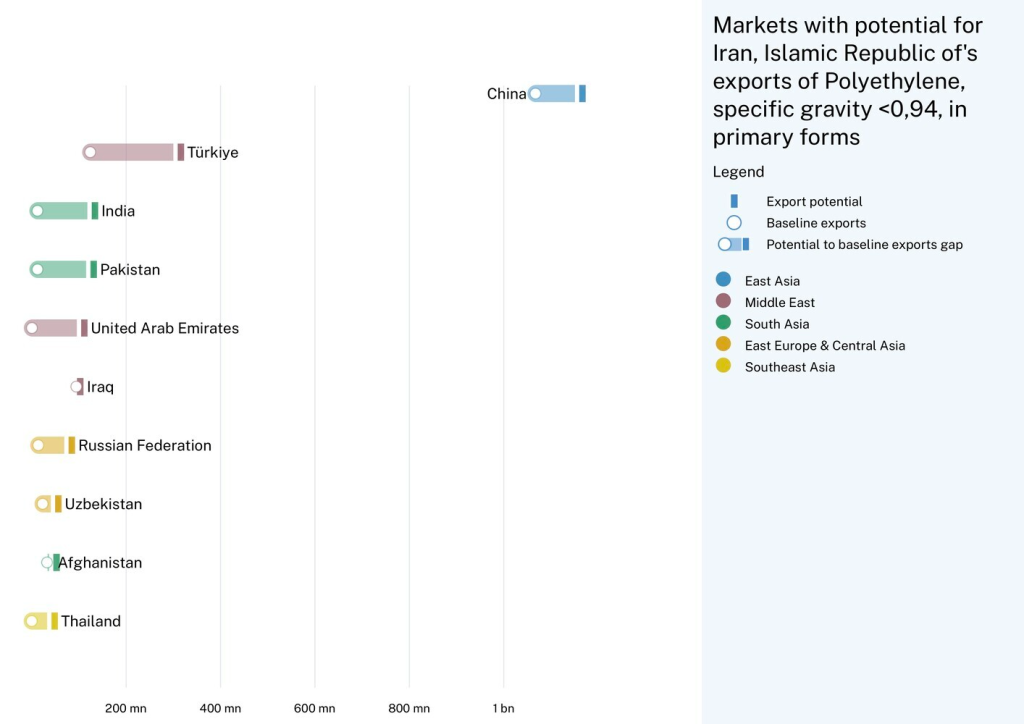

LDPE Future Markets (2025–2030):

For LDPE, China will also stay in first place. At the same time, Turkey, India, the UAE, and Pakistan show strong growth potential. Focusing on these markets can help Iran create more balanced exports and lower the risks of over-dependence on China.

In short, the future of Iran’s polyethylene exports is not limited to China. Countries like Turkey, India, and the UAE will open new opportunities for buyers and suppliers. For global buyers, this means more options and competitive prices; for Iranian exporters, it means more stable income and lower risks.

Regional Demand & Easy-to-Access Markets

Beyond the big buyers like China and Turkey, Iran’s polyethylene trade also relies on strategically simple markets. These destinations may not have the largest demand, but they offer:

- Lower entry barriers

- Shorter logistics routes

- More stable trade conditions

According to IRICA and Trade Map data:

– Easier HDPE export destinations:

- Azerbaijan

- Armenia

- Iraq

- Syria

- Uzbekistan

– Easier LDPE export destinations:

- Azerbaijan

- Iraq

- Afghanistan

- Tajikistan

- Uzbekistan

By combining high-demand markets with these easy-to-access destinations, Iranian suppliers can achieve both growth and stability in polyethylene exports.

Conclusion & Strategic Outlook

Over the last decade, Iran’s polyethylene exports have proven their strength in the global market. Both HDPE and LDPE shipments have reached millions of tons annually, supported by official IRICA and Trade Map data. The numbers confirm Iran’s position as a reliable, cost-efficient, and strategically located supplier of polymer raw materials.

At the same time, the analysis highlights a clear challenge: over-reliance on China. While China will continue to drive demand, opportunities in Turkey, India, UAE, Pakistan, and Central Asia are too important to ignore. By tapping into these diverse and accessible markets, Iranian exporters can reduce risks and secure more stable revenue streams.

For international buyers, sourcing polyethylene from Iran means:

- Access to HDPE & LDPE at globally competitive prices

- Consistent supply backed by large production capacity

- Lower logistics costs thanks to Iran’s geographic advantage

- Opportunities in less competitive regional markets

👉 At Call2Supply, we go beyond data. With over 10 years of team expertise in the Middle East polymer trade, we turn market analysis into actionable strategies. Whether you’re looking to import HDPE, LDPE, or explore new high-potential markets, our team is here to make the process fast, safe, and profitable.

📞 It Takes Just A Call 2 Supply — contact us today and unlock new growth opportunities in Iran’s polyethylene trade.

Ready to Source from Iran? contact-us