Introduction

Iran is emerging as a notable player in the global Iran soda ash export market, driven by competitive production costs, proximity to key regional buyers, and expanding petrochemical capacity. Iran soda ash export has become increasingly significant for international buyers, as soda ash (sodium carbonate) is a foundational industrial chemical used widely in glass manufacturing, detergents, water treatment, and various chemical industries — making it an essential commodity for many downstream sectors. As international demand recovers and supply chains reconfigure, understanding the Iran soda ash export landscape in 2025 is crucial for buyers, traders, and industry analysts.

This article examines the Iran soda ash export market 2025, identifying leading Iranian soda ash suppliers, pricing dynamics, and the most promising destination markets for Iran soda ash export. We combine national customs data (IRICA), international trade records (Trade Map), and export-potential mapping to highlight where Iranian soda ash is currently sold and where opportunities remain untapped. Whether you are a procurement manager, distributor, or investor, this market overview offers actionable insights into Iran soda ash export prices, logistical advantages, and top buyers — helping you evaluate sourcing from Iran with clarity.

Overview of Soda Ash Production in Iran

Iran holds a strong industrial base for soda ash (sodium carbonate) production, supported by abundant natural resources, access to low-cost energy, and a well-developed petrochemical infrastructure. The country’s soda ash industry has expanded steadily over the past decade, with growing investments from both government-backed and private producers. Key Iranian soda ash suppliers include facilities such as Sachi Soda Company, Semnan Soda Ash Plant, which collectively contribute to most of the nation’s output.

Iran’s central and western regions provide ideal conditions for soda ash manufacturing, thanks to rich deposits of salt and limestone — the essential raw materials for sodium carbonate production. Combined with competitively priced natural gas, Iran can produce soda ash at costs significantly lower than many global competitors. This cost advantage allows the country to remain competitive in regional and international markets.

In 2025, Iran’s soda ash capacity is estimated to exceed several hundred thousand metric tons annually, positioning it as one of the most promising suppliers in the Middle East. The domestic production is primarily directed toward export markets in Asia, the Persian Gulf region, and Africa. Continuous modernization of production technology and adherence to international quality standards have further enhanced Iran’s reputation in the soda ash export market 2025, strengthening its role as a dependable and price-competitive supplier.

Export Performance Based on IRICA Data (2024–2025)

According to the Iranian Customs Administration (IRICA), the country’s soda ash export performance during 2024 (Iranian year 1403) demonstrated remarkable strength and regional competitiveness. Iran exported a total of 307,231,081 kilograms of sodium carbonate (HS code 28362000) valued at USD 44,679,165, positioning it as a key player in the soda ash export market 2025. This export level underscores Iran’s capability to supply global buyers with high-quality and cost-efficient soda ash at a competitive price averaging around USD 145 per ton.

Global Trade Analysis (Trade Map & Competitor Landscape)

The global soda ash market remains dominated by a handful of major suppliers and export geographies. While Iran is still a relatively modest supplier in global terms, the country’s 2024 export figures demonstrate a strong foothold in key regional markets and an opportunity to ascend further.

In 2024, Iran exported about 307 million kg (USD 44.68 million) of soda ash (HS code 28362000) — according to national customs data. Despite the global dominance of major producers, this scale positions Iran as a niche but growing exporter, especially focused on Asian neighbours. The concentration of exports toward India (120.9 million kg / USD 17.6 million) and China (108.5 million kg / USD 15.8 million) underscores Iran’s deep penetration in high-demand markets, contrasting with much larger but more diversified exporters elsewhere.

Looking at broader export patterns, the United States, China and Turkey each report annual soda ash exports measured in millions of tons. For Iranian exporters, this means that while global competition is intense, Iran’s cost advantages — low-cost energy, proximity to buyers, regional logistics — can help it carve out an export niche.

However, the country still faces a challenge: global share and diversification. Unlike the top global exporters, Iran’s export portfolio is heavily concentrated in two major buyers — India and China — which account for over 75 % of export value for 2024. Such concentration elevates risk and limits flexibility. To mitigate this, Iran needs to broaden its reach into markets where the major exporters are less entrenched or where regional logistics give a competitive edge (for example Southeast Asia or the Middle East).

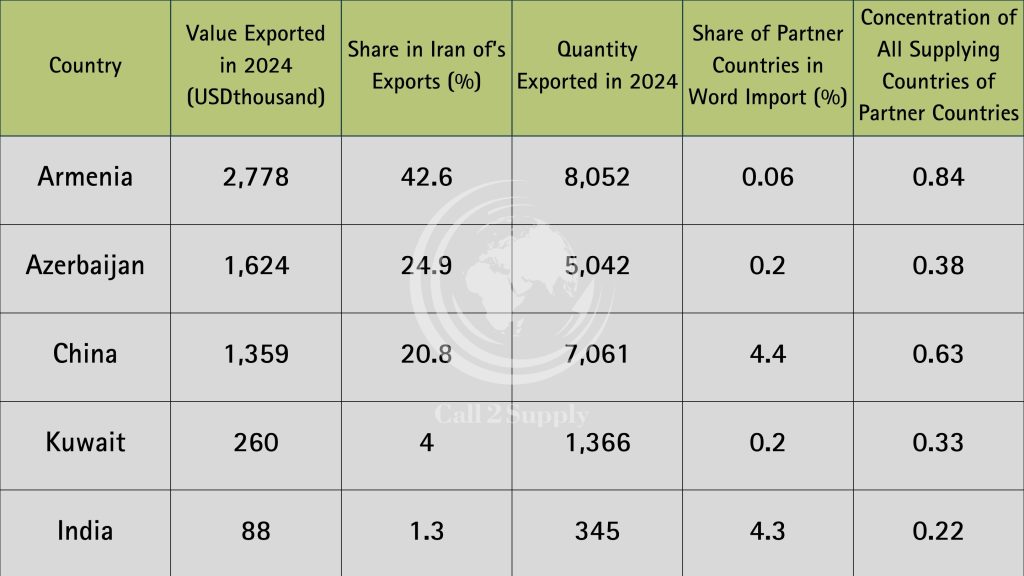

While detailed global‐share data for Iran is limited, the trajectory is upward — especially as large buyers such as India begin to diversify supply sources. In this context, the “soda ash export market 2025” for Iran is less about chasing the absolute leader positions and more about maximizing regional strength, offering competitive pricing, and securing long-term contracts with emerging importers.Based on IRICA’s 2024 data, India and China dominated as Iran’s top export destinations, jointly accounting for over 75 % of total export value. India imported 120.8 million kg (USD 17.6 million), while China followed with 108.5 million kg (USD 15.8 million). Other notable destinations included Indonesia (USD 2.7 million), Armenia (USD 1.42 million), Malaysia (USD 1.25 million), and Myanmar (USD 0.99 million). This diversified portfolio highlights Iran’s strong regional reach across South and Southeast Asia, supported by geographic proximity, stable logistics, and growing demand for industrial soda ash in glass, detergent, and chemical sectors.

However, in the first five months of 2025 (1404), total export volumes declined to 74,747,086 kg valued at USD 10,840,173, reflecting a contraction of nearly 45 % compared to the same period in the previous year (134,941,695 kg | USD 19,582,771). Despite the drop, Iran sustained its foothold in key Asian markets. India remained the leading buyer with 38.5 million kg (USD 5.58 million), followed by China (USD 1.98 million), Bangladesh (USD 1.01 million), Armenia (USD 0.95 million), Azerbaijan (USD 0.36 million), and Malaysia (USD 0.14 million). The emergence of Bangladesh and Azerbaijan among the top importers reflects evolving regional trade opportunities and increasing diversification in Iran’s export landscape.

In conclusion, the Iran soda ash export sector remains resilient, supported by established buyers like India and China and new market openings in South Asia. Nevertheless, sustaining export growth in 2025 will require addressing logistics challenges, stabilizing production costs, and expanding outreach to high-demand markets in Indonesia, Malaysia, and Southeast Asia.

Top Buyers & Export Potential for Iran’s Soda Ash (2025–2030)

Analyzing the 2025 customs data and comparing it with 2024 shows a clear shift in the geography of Iran soda ash export. During the first five months of 2024, Iran exported around 134.9 million kg (USD 19.58 million), while in the same period of 2025, Iran soda ash export dropped to 74.7 million kg (USD 10.84 million). This represents a nearly 50 % decline, both in value and volume. However, within this drop lies valuable insight into evolving buyer patterns and new market potential for Iran soda ash export, highlighting opportunities for exporters to adjust strategies and target emerging importers.al.

1. Top Buyers of Iranian Soda Ash in 2025

According to export data, India and China remain the top two importers, accounting for over 68 % of total export value during the first half of 2025. Despite reduced quantities compared to the previous year, both countries maintain consistent purchasing activity, highlighting Iran’s reliability as a regional supplier.

Interestingly, Bangladesh has emerged as a new key buyer, importing 7 million kg (USD 1.01 million) of Iranian soda ash in early 2025. Armenia and Azerbaijan also continue to play essential roles, with stable trade volumes and short-distance logistics advantages. Smaller buyers like Malaysia and Myanmar represent secondary but promising destinations that could be expanded with better pricing and freight efficiency.

| Rank | Country | Volume (Kg) | Value (USD) | Note |

|---|---|---|---|---|

| 1 | India | 38,540,191 | 5,585,766 | Stable long-term buyer |

| 2 | China | 13,730,000 | 1,989,787 | Potential for growth |

| 3 | Bangladesh | 7,000,000 | 1,014,752 | New emerging market |

| 4 | Armenia | 6,561,870 | 951,393 | High supplier dependence |

| 5 | Azerbaijan | 2,470,470 | 358,128 | Easy logistics & border trade |

2. Regional Export Potential

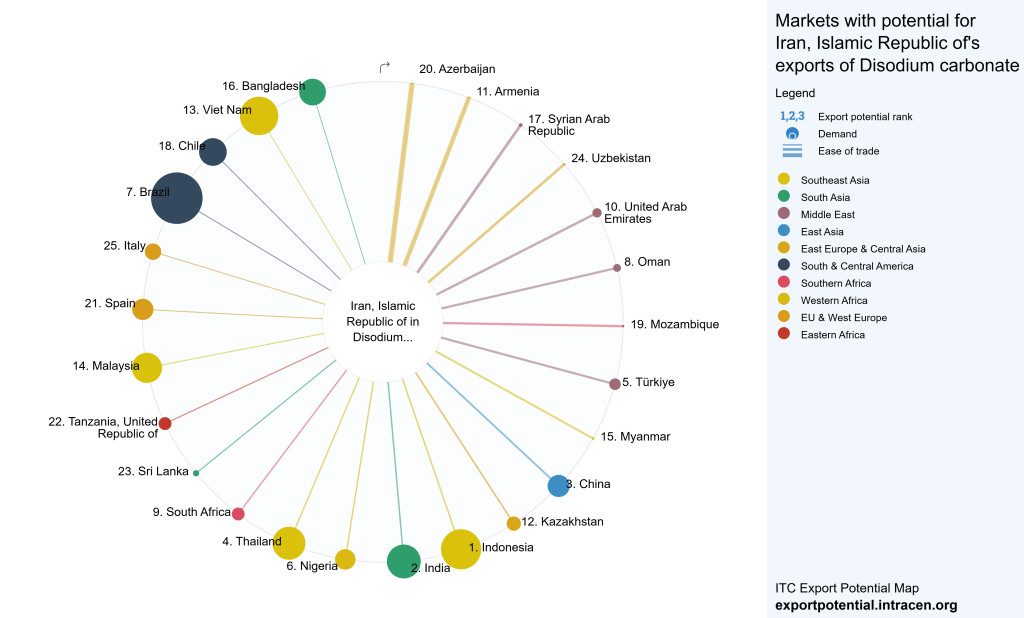

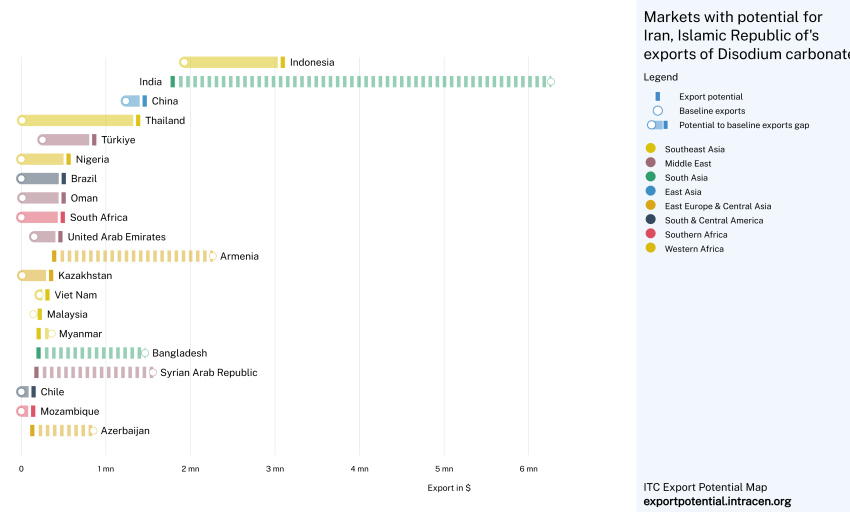

Based on Export Potential Map analysis, Iran’s soda ash exports hold strong growth potential in Southeast Asia and the Middle East.

- Indonesia and Thailand stand out with high import growth projections between 2025 and 2030. These markets are price-sensitive but growing rapidly in glass and detergent manufacturing sectors.

- Turkey, Nigeria, Brazil, Oman, the UAE, and Kazakhstan show a rising medium-term potential driven by industrial development and import diversification.

- Armenia and India, while currently dominant buyers, are expected to show a slight decline in growth potential — a warning sign for exporters relying heavily on these destinations.

3. Easiest Markets for Iranian Soda Ash

From a logistics and trade-facilitation perspective, the easiest export destinations for Iranian soda ash remain Azerbaijan, Armenia, Syria, Uzbekistan, and the UAE.

These countries offer short transport distances, favorable trade agreements, and lower import barriers. Such accessibility gives Iranian producers a competitive edge in pricing and delivery time compared to distant suppliers from the US or Europe.

4. Strategic Outlook 2025–2030

The next five years will define whether Iran can transform its current export network into a sustainable, diversified market structure. The key opportunities lie in:

- Expanding to Southeast Asia (especially Indonesia, Thailand, and Malaysia)

- Maintaining strong presence in India and China while reducing dependency

- Leveraging logistics advantages in nearby markets (Caucasus and Gulf countries)

- Securing long-term trade contracts with emerging importers

- Enhancing brand reliability through consistent product quality and certification compliance

By strategically aligning production, pricing, and partnerships with these market opportunities, Iranian soda ash exporters can not only recover the decline observed in 2025 but also achieve long-term regional dominance by 2030.

Conclusion: Building a Stronger Future for Iran’s Soda Ash Exports

Iran’s soda ash industry has demonstrated resilience and adaptability despite market fluctuations and global competition. Between 2024 and 2025, while export volumes experienced a temporary decline, the country maintained strong regional ties with key partners such as India, China, and Armenia. These relationships continue to provide a foundation for future expansion, supported by Iran’s geographical advantages, cost-efficient production, and access to fast-growing consumer markets.

However, the data also highlights the urgent need for diversification. Overreliance on a limited number of buyers exposes exporters to market volatility and price pressure. As global demand for soda ash continues to increase—especially in the glass, detergent, and lithium battery sectors—Iranian suppliers have the opportunity to strengthen their export strategies and secure new long-term partnerships.

Strategic Recommendations for 2025–2030

- Market Diversification: Focus on emerging markets such as Indonesia, Thailand, and the UAE, which show promising growth potential.

- Quality & Certification: Achieve international quality compliance (ISO, REACH) to attract global buyers and enter high-value markets.

- Sustainable Logistics: Develop efficient port and land transport routes, particularly via Bandar Abbas and northern border crossings, to reduce costs and delivery time.

- Long-Term Contracts: Build stable export agreements with large industrial buyers to secure consistent demand and reduce price risks.

- Digital Visibility: Utilize digital trade platforms and data-driven sourcing tools to improve transparency and buyer outreach.

Call2Supply: Your Trusted Partner in Sourcing Iranian Soda Ash

At Call2Supply, we combine real-time trade data, logistics insights, and supplier verification to connect international buyers with reliable Iranian soda ash producers.

Our mission is to simplify the sourcing process by ensuring quality assurance, transparent pricing, and efficient trade coordination — helping importers and distributors gain a competitive advantage in the regional and global markets.

Whether you’re looking to purchase high-purity soda ash or to explore new distribution opportunities in the Middle East and Asia, Call2Supply stands as your trusted bridge between Iranian suppliers and global demand.