Mono Ethylene Glycol (MEG) is an essential petrochemical widely applied in polyester fibers, PET resins, packaging, antifreeze, and various industrial chemicals. Global demand for MEG continues to rise steadily, driven by expansion in the textile, packaging, automotive, and consumer goods sectors. As a result, securing a reliable and cost-competitive MEG supply has become increasingly important for manufacturers and traders worldwide.

Iran has emerged as a prominent MEG exporter and a competitive MEG supplier from Iran, supported by advanced petrochemical infrastructure, access to low-cost natural gas feedstock, and substantial production capacity. In This article Call2Supply provides a structured overview of Iran’s MEG trade dynamics, including export volumes, destination markets, price trends, and future opportunities. The analysis is updated with 2025 global market context and is designed for international buyers, traders, and industry professionals evaluating sourcing options from Iran.

Note: All export volumes, destination shares, and trade values cited in this article are derived from IRICA (Islamic Republic of Iran Customs Administration) statistics and official export potential reports. Price references reflect reported market transactions and regional benchmarks.

Iran MEG Export Statistics

According to IRICA, Iran’s MEG exports in 1403 were substantial, reflecting its position as a competitive supplier in international markets.

Total Exports in 1403

- Total Volume: 963,012,343 kg

- Total Value: USD 450,997,182

MEG ranks among Iran’s most significant petrochemical exports in both volume and revenue. Stable production and export capacity ensure Iran can meet international demand reliably.

Mid-Year Export Comparison

- Up to Mid-Year 1403: 451,533,233 kg | USD 208,468,485

- Up to Mid-Year 1404: 439,388,982 kg | USD 195,302,499

The slight decrease in 1404 aligns with global MEG market cyclicality rather than a production issue. Factors include pricing fluctuations, logistical constraints, and shifting buyer strategies.

Key Export Destinations

Iran mono ethylene glycol exports are predominantly concentrated in Asian markets, reflecting regional demand patterns and logistical advantages. However, trade data from IRICA assessments indicate that Eurasian and selected European markets also present meaningful opportunities for diversification and long term growth.

1. China – Primary Market

- Volume: 878,236,707 kg

- Value: USD 415,354,738

China represents the cornerstone of Iran’s MEG export portfolio, accounting for over 90% of total export volumes. This dominance is primarily driven by China’s extensive polyester fiber, PET resin, and synthetic textile industries, which rely heavily on large-scale and cost-efficient MEG imports.

2. Russia – Growing Strategic Partner

- Volume: 28,846,320 kg

- Value: USD 10,190,246

Russia has emerged as an increasingly important destination for Iranian MEG exports, supported by its expanding industrial base and downstream chemical consumption. Demand is largely linked to polyester applications, industrial coolants, and chemical intermediates used in manufacturing and infrastructure projects.

3. Bangladesh – Textile-Driven Market

- Volume: 26,606,186 kg

- Value: USD 12,722,855

Bangladesh is one of the world’s fastest-growing textile and garment manufacturing hubs, with a strong dependence on imported raw materials such as MEG for polyester fiber production. The country’s export-oriented textile industry ensures consistent baseline demand for MEG, making it a relatively stable destination market.

4. Uzbekistan and UAE

- Uzbekistan: 9,665,771 kg | USD 4,223,070

- UAE: 4,168,554 kg | USD 1,646,613

Although smaller in absolute volume, Uzbekistan and the UAE play distinct strategic roles in Iran’s MEG export landscape. Uzbekistan’s growing manufacturing and textile sectors are gradually increasing demand for chemical feedstocks, positioning the country as a potential emerging market within Central Asia. The UAE, while importing more limited volumes for domestic use, serves a critical function as a regional trading and re-export hub. MEG shipments to the UAE can facilitate indirect access to markets across the Middle East, Africa, and South Asia, enhancing trade flexibility and market reach for Iranian exporters.

Collectively, these destinations highlight the importance of regional diversification and underscore the potential for Iran to expand its mono ethylene glycol export footprint beyond its primary Asian markets.

MEG Price Insight

MEG pricing depends on supply demand dynamics, production costs, logistics, and market cycles rather than fixed numbers.

Key Price Drivers:

- Feedstock Costs: Ethylene and crude oil prices

- Regional Demand: Primarily Asia (China, India)

- Logistics & Freight: Shipping delays, container availability

- Production Rates: Capacity and maintenance schedules

- Seasonality: Textile and packaging industry cycles

Monitoring these factors allows Iranian exporters to remain competitive, while buyers can align procurement with market trends.

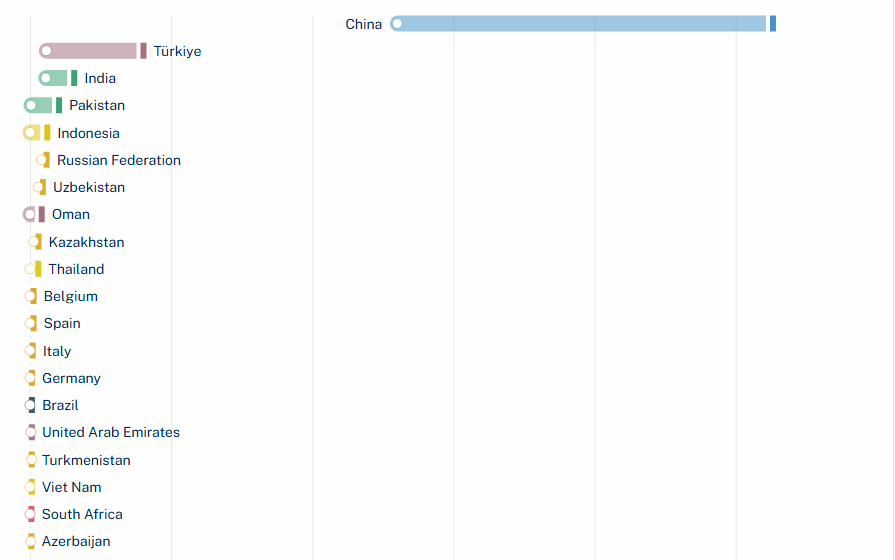

Export Potential Map: Untapped Markets

According to the ITC Export Potential Map (HS Code 290531 – Ethylene Glycol), Iran MEG exports to:

- Asia: India, Pakistan, Indonesia, Thailand

- Europe: Belgium, Italy, Spain, Germany

- Eurasia: Turkey, Uzbekistan, Kazakhstan

Entering these markets allows Iran to diversify, reduce risk, and capture additional market share.

Strategic Importance of Diversification

- Revenue stability

- Reduced geopolitical risk

- Enhanced brand recognition

European markets provide high-value opportunities, while South and Southeast Asia offer volume-driven growth.

Role of Reliable MEG Suppliers – Call2Supply

Export success is not just about production. Reliable suppliers ensure:

- Consistent product quality

- On-time, compliant deliveries

- Market intelligence and transparent communication

Call2Supply, as a specialized MEG supplier, exemplifies professional supply chain management. Their transparent, logistics-ready approach builds trust with international buyers, reduces risk, and ensures smooth transactions. In an industry where delays or quality inconsistencies can cause financial losses, partnering with trusted suppliers like Call2Supply is crucial.

Challenges and Considerations

- Market Concentration: Over 90% of exports go to China.

- Price Volatility: Feedstock and freight costs impact stability.

- Logistical Constraints: Shipping schedules, container shortages, and customs delays.

- Regulatory Compliance: Adhering to importing countries’ chemical and quality standards.

Strategic partnerships, diversified markets, and professional suppliers like Call2Supply help mitigate these challenges.

Outlook

Iran’s MEG export outlook is positive:

- Strong production capabilities

- Competitive pricing

- Growing demand in Asia

- Untapped European markets

Growth depends on diversification, price monitoring, and collaboration with reliable suppliers like Call2Supply.

Conclusion

In 1403, Iran exported 963,012 tons of MEG, generating nearly USD 451 million. China is the dominant buyer, but diversification is essential.

MEG prices depend on feedstock costs, regional demand, logistics, and production cycles. ITC Export Potential Map identifies high-growth markets in Asia, Eurasia, and Europe. Partnering with professional suppliers like Call2Supply ensures trade reliability, consistent supply, and credibility in the global MEG market.

With the right strategies and professional supply chain management, Iran is well-positioned to expand its global MEG footprint.